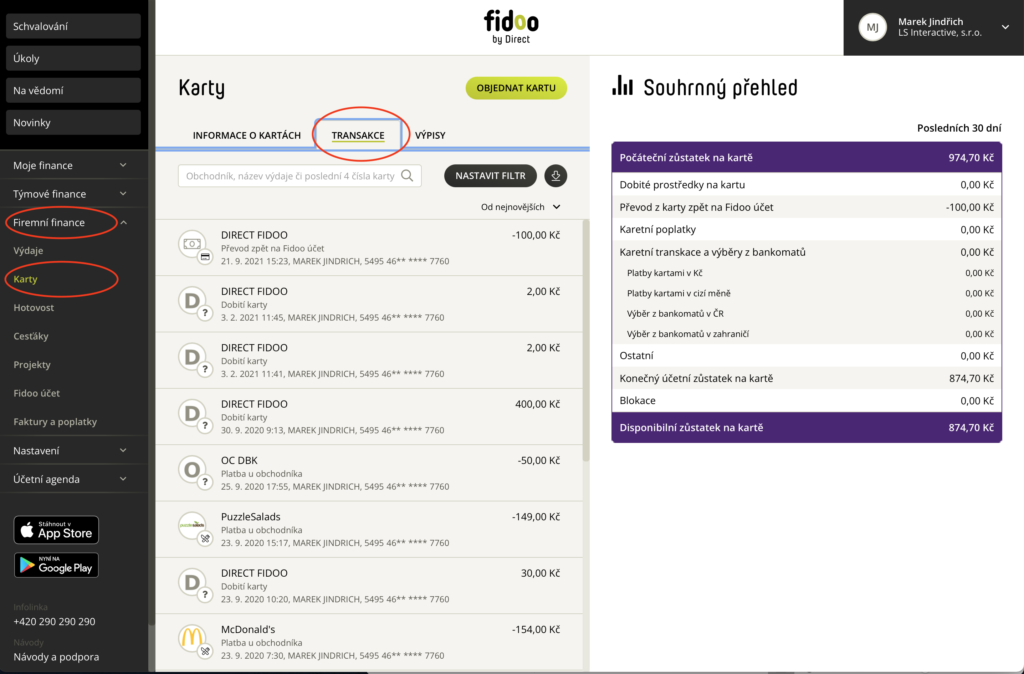

Wallet top-up (cash withdrawal)

Web app

- Corporate Finance – Cash – select Charge Wallet.

- Select the user, fill in the required fields and attach the cash receipt and select Charge.

Mobile applications

- Bottom menu –

Cash

– select the tab

Corporate.

- Click on

or

or  and select

and select

Charge

. - Take a photo of the cash receipt, fill in the necessary details and

Save

.

Unloading your wallet (receiving cash)

Web app

- Corporate Finance – Cash – select Unload Wallet.

- Select the user, fill in the required fields and attach the cash receipt and select Withdraw.

Mobile app

- Bottom menu –

Cash

– select the tab

Corporate.

- Click

or minus and select

or minus and select

Unload

. - Take a photo of the cash receipt, fill in the necessary details and

Save

.

Frequently asked questions about the web or mobile application

Already created card game transaction cannot be deleted, so it is necessary to create another “correction” entry.

Example: we wanted to top up CZK 1,000 to a user, but we accidentally entered CZK 10,000. So we create a “correction” cash transaction and debit the wallet by CZK 9,000.

From 7. 12. In 2021, only the web interface can be used for charging via phone; in the future, this function will be part of the mobile app.

Yes, you can work with all currencies around the world.